Articles

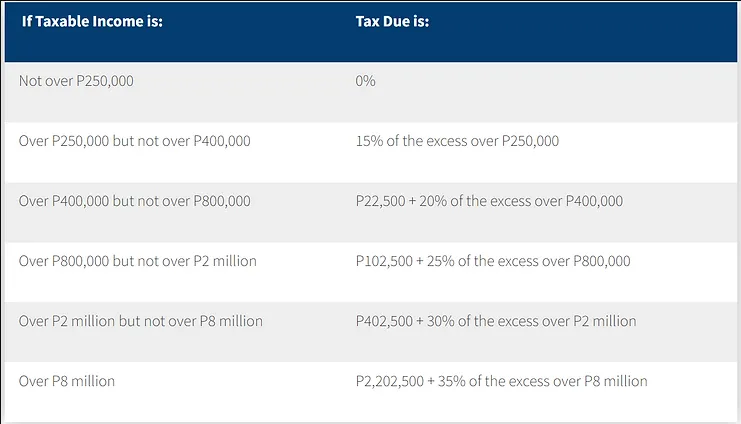

The annual income tax filing was also approaching as the new year began, but there is more to look forward to this year because of Republic Act 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) Law, which will inevitably result in lower personal income taxes for taxpayers starting on January 1, 2023.

Over the years, BIR has sought to simplify the process and elevate the convenience of registering taxpayers. In light of Revenue Memorandum Order (RMO) No. 06-2018 enhancing the frontline services of the Bureau of Internal Revenue (BIR) by streamlining tax-related transactions, Revenue Memorandum Circular (RMC) No. 19-2018 was issued to circularize the simplified business registration guidelines and procedures.

This article explains the steps and requirements for filing a business closure (also known as a cessation of registration) with the BIRBusiness closures occur for a variety of reasons, but regardless of the reason, it is critical to understand that you cannot simply cease operations. It is your responsibility as a business owner or self-employed individual running a freelance business to perform the due diligence required to close the business properly. Let's look at what this means and what is required to do so.

What is a Corporation?

A corporation is a legal entity that is separate and distinct from its owner or incorporators. It has legal rights and obligations similar to an individual. It can enter into contracts, loan, hire employees, pay taxes, etc. It is formed by at least five (5) individual called incorporators.The ownership of a corporation is divided into shares of stock. A corporation issues the stock to individuals or other businesses, who then become owners or stockholders of the corporation.

Every business has its own Income and Expenses that needs to be monitored so you would know where your business is standing. However, not all expenses can be deducted for your taxes, and we have to observe certain tests and limitations in claiming expenses.

In theory, all of the concepts below have to be followed, but in the real world, not all comply. This is not only a test of skills and technical knowledge, but it is more a test of integrity.

It is wise to make sure that your company's accounts are constantly prepared for audits throughout the year if you operate a business in the Philippines. To avoid any trouble during audits carried out by the Bureau of Internal Revenue (BIR), it is best practice to regularly maintain your accounts organized and up to date.

Here are several methods for keeping your company audit-ready all year long, from regularly updating your records to addressing developments since the last BIR audit.

In the landscape of global business, the hunt for efficient, cost-effective solutions is never-ending. Among the plethora of outsourcing options, the Philippines has established itself as a standout choice for companies looking to streamline their operations and maximize their potential. Here's why the Philippines is a top-tier choice for outsourcing.

In the fast-paced world of global business, companies are constantly seeking innovative ways to optimize their operations and maximize their potential. One strategy that's gaining popularity is partnering with finance freelancers or bookkeepers from the Philippines. With their exceptional skills, cultural compatibility, cost-effectiveness, and proven track record, the Philippines offers a relaxed and fruitful destination for businesses in the US, Canada, New Zealand, and beyond. In this blog, we'll explore the exciting advantages that await businesses looking to enhance their financial operations by teaming up with talented finance professionals from the Philippines.

Online sellers on platforms like Lazada, Shopee, and TikTok must familiarize themselves with the recent Bureau of Internal Revenue (BIR) Regulation, RMC 55-2024, to ensure proper tax compliance. This regulation aims to bring clarity to the taxation of e-commerce transactions and online selling activities, making it crucial for online sellers to understand their tax obligations and responsibilities.

Over the years, businesses have undergone significant changes in their invoicing processes, and adapting to these transitions is crucial for success. It's vital for businesses to comply with legal requirements when it comes to issuing invoices to avoid penalties and legal issues. Understanding the nuances of invoicing is critical in maintaining financial health and fostering strong relationships with clients. Let's research into the world of invoicing and uncover what businesses need to know to navigate this transition smoothly.

As per the Revenue Memorandum Circular No. 61-2024, the updated version of the Alphalist Data Entry and Validation Module (Version 7.3) is now available for use and can be downloaded here.

The Alphanumeric Tax Codes (ATCs) previously missing are included in this upgrade. See the newly added ATCs in this article:

The Taxpayer Account Management Program (TAMP) is a program managed by the Revenue District Office (RDO) responsible for at least 80% of the district's tax collection. TAMP taxpayers are strictly monitored for compliance with revenue rules and regulations, including the submission of required information returns and lists, and for significant changes in revenue payments.

The Ease of Paying Taxes (EOPT) Act introduces several significant changes to Value-Added Tax (VAT) rules in the Philippines based on the RMC 65-2024 issued-on June 14, 2024, to clarifies certain issues relative to the implementation of Section 19 of Republic Act No. 11976 (EOPT Act).

The Bureau of Internal Revenue implemented the eSales to improve the taxpayer voluntary compliance and increase the revenue collections, since this system can help to effectively monitor and validate the accuracy of the generated sales by the electronic machines prescribed by the BIR.

The Bureau of Internal Revenue (BIR) released the revenue regulation on June 13, 2024. This RR 11-2024 is to amend the transitory provisions of RR 7-2024, posted last April 11, 2024, relative to the deadlines for compliance with the invoicing requirements.

Ease of Paying Taxes (EOPT) was signed into a law on January 5, 2024, by President Ferdinand Marcos Jr. under Republic Act No. 11976 which took effect last February 22, 2024.

Contact Us

Email:

Address:

Unit 1B, Lleida Tower, Circulo Verde, Calle Industria,

Quezon City, MNL 1110, Philippines

Looking For a Job?

We are hiring for Part-Time Virtual Bookkeepers for our clients!

© 2023 by Upcloud Accounting. Created by Genuinely Business Solutions.