Stop, Read, and Comply with the BIR: RR 11-2024 Amending the Recent RR 07-2024

The Bureau of Internal Revenue (BIR) released the revenue regulation on June 13, 2024. This RR 11-2024 is to amend the transitory provisions of RR 7-2024, posted last April 11, 2024, relative to the deadlines for compliance with the invoicing requirements.

The transitory provisions can be found in Section 8 of RR 7-2024.

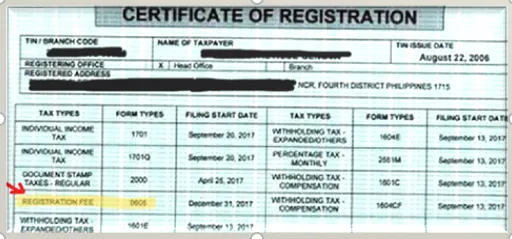

Certificate of Registration - Taxpayers are NOT REQUIRED to replace their COR that displays the line-item REGISTRATION FEE. It will retain the validity even if the registration fee is shown therein and they are also no longer required to pay the annual fee of 500 pesos every January.

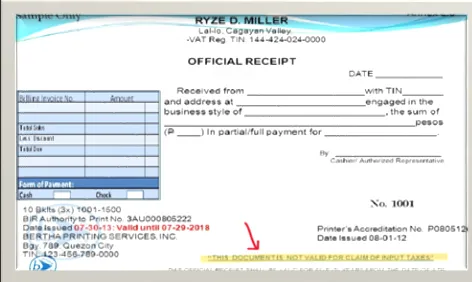

Unused of Official Receipts

Taxpayers may continue the use of OFFICIAL RECEIPTS as SUPPLEMENTARY DOCUMENT until FULLY CONSUMED upon the

effectivity date of the regulations which is April 11, 2024. For VAT Registered Taxpayers, provided that the phrase THIS DOCUMENT IS NOT VALID FOR CLAIMING OF INPUT TAX is stamped on the face of the receipt.

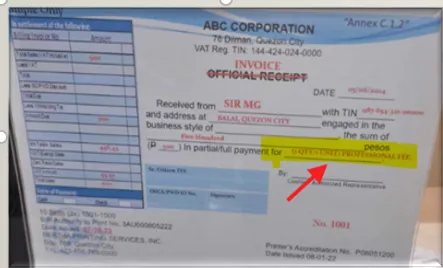

Taxpayers may convert and use the remaining OFFICIAL RECEIPTS as INVOICE and convert the Billing Statement/Statement of Account or Charges into BILLING INVOICE.

- In line with the EOPT, taxpayers shall be allowed to strikethrough the word OFFICIAL RECEIPT/BILLING STATEMENT [e.g OFFICIAL RECEIPT, BILLING STATEMENT] on the face of the manual and loose leaf printed receipt and stamp INVOICE or any name describing the transaction and to be issued as PRIMARY INVOICE to its buyer/purchases UNTIL FULLY CONSUMED. Amending the initial deadline from RR 7-2024 which is December 31, 2024. Provided, that the converted “Official Receipt or Billing Statement” shall contain the required information required information provided under Section 6(B) of RR 7-2024 including:

a. quantity

b. unit cost

c. description or nature of service

Such information and other required information may also be stamped if not originally indicated in the existing receipts to comply with these requirements.

If the above documents comply, it shall be CONSIDERED VALID for claiming of input tax by the buyer/purchases for the period issued from APRIL 27, 2024, until they are FULL CONSUMED. Again, provided that the converted invoice to be issued has “Invoice” stamp and there is NO MISSING INFORMATION as enumerated under Section 3(D)(3) of RR 7-2024. Any manual/loose leaf OR issued without the stamped will be considered supplementary documents.

Note that stamping Official Receipt as Invoice or Billing Statement by taxpayers does not require approval from any RDO by complying with Section 8 (2.3). However, taxpayers must submit Inventory List of Unused ORs to be converted as Invoice to their respective RDO on or before July 31, 2024, indicating the number of booklets and corresponding serial numbers. They have the option to submit online.

Taxpayers should obtain newly printed invoices with an Authority to Print (ATP) before fully using or consuming the converted receipts.

Due to the Ease of Paying Taxes Act (EOPT) wherein it no longer requires the issuance of Official Receipts, it operates to establish the INVOICE. According to the RR No. 7-2024, INVOICE is defined as principal invoice evidencing the sale of goods and/or services issued to customers in the ordinary course of trade or business. Invoice is classified as VAT Invoice and Non-VAT Invoice.

Cash Register Machines (CRM) and Point-of-Sales (POS) Machines and E-receipting or Electronic Invoicing Software

Taxpayers may change the word OR to Invoice or any name describing the transaction, without the need to inform the RDO of having jurisdiction over the place of business since it is considered as minor system enhancement.

However, for taxpayers using duly registered Computerized Accounting System (CAS) or Computerized Books of Account (CBA) with Accounting Records shall be considered as major enhancement which will require them to update their system registration since it has a direct effect on their financial aspect. The process for this is the previously issued Acknowledgement Certificate or Permit to Use shall be surrendered to the RDO where the taxpayer is registered, and a new Acknowledgment Certificate shall be issued to the Head office/Branch(es). Adjustment shall be undertaken on or before December 31, 2024. But, if ever they need an extension due to the reconfiguration must be approved by the concerned authority which shall not be longer than six months from December 31, 2024.

Upcloud Accounting

Virtual Outsourced Accounting and Bookkeeping Services in the Philippines

Upcloud Accounting offers online accounting and bookkeeping services specializing with startups and SMEs in the Philippines.

Our goal is to increase efficiency, automation, and transparency across the accounting and finance functions of our clients with our cutting-edge technology.

If you want to move your company’s finance function online, contact our Team of Expert Accountants and Bookkeepers directly via [email protected] or visit www.upcloudaccounting.com to learn more about how Upcloud Accounting accounting services can support your PH business!

Disclaimer: This article or blog is only for general knowledge and guidance and is not a substitute for an expert opinion. For technical advice, please consult your tax / legal advisor for your specific business concerns. For comments, suggestions, and feedback, feel free to email us at [email protected]

Click the button below to schedule a FREE online consultation with us.

© 2023 by Upcloud Accounting. Created by Genuinely Business Solutions.