Lower Income Tax Rates for the Year 2023, Higher Take-Home Pays

The annual income tax filing was also approaching as the new year began, but there is more to look forward to this year because of Republic Act 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) Law, which will inevitably result in lower personal income taxes for taxpayers starting on January 1, 2023.

This is excellent news for all taxpayers as increased take-home pay can be anticipated with the lower income tax rates. According to Benjamin Diokno, the Secretary of Finance, the TRAIN Law, which modifies personal income taxes, addresses the unfairness of the tax system. With these lower income tax rates, taxpayers can continue to contribute fairly to societal advancement while also enjoying a greater part of the rewards of their labor.

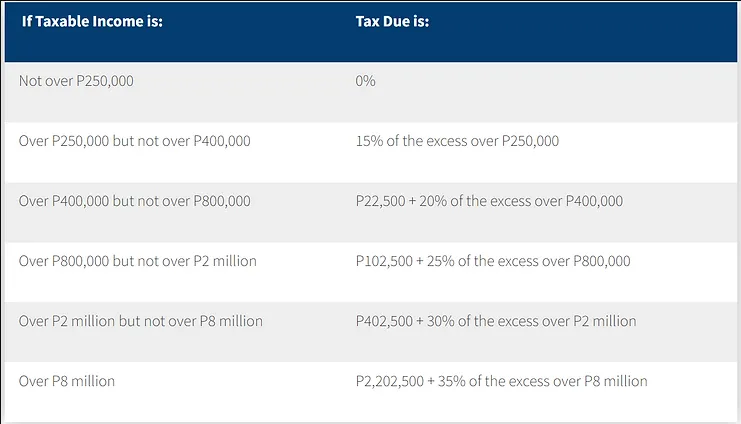

Let’s take a look with the new Tax Schedule starting 2023 and onwards:

Although the income tax rates have changed, taxpayers with taxable incomes of P250,000 or less are still exempt, and those making more than P8 million are still subject to a 35% tax rate. The lower income tax rates will primarily help taxpayers who formerly paid income taxes with rates ranging from 20% to 32% because they are now subject to rates between 15% and 30%, depending on the tax bracket to which they belong.

BIR Form to use, Deadline, and List of requirements for Income Tax Filing

I. Annual Income Tax For Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Related Income)

A. BIR Form 1700 - Annual Income Tax For Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Related Income

B. Deadline - On or before the 15th day of April of each year covering taxable income for calendar year 2018 and thereafter

C. Documentary Requirements:

Certificate of Income Tax Withheld on Compensation (BIR Form 2316)

Duly approved Tax Debit Memo, if applicable

Proofs of Foreign Tax Credits, if applicable

Income Tax Return previously filed and proof of payment, if filing an amended return for the same taxable year.

II. Annual Income Tax For Individuals, Estates, and Trusts

A. BIR Form 1701 - Annual Income Tax Return Individuals, Estates and Trusts

B. Deadline - Final Adjustment Return or Annual Income Tax Return - On or before the 15th day of April of each year covering income for calendar year 2018 and thereafter

C. Documentary Requirements

Certificate of Income Tax Withheld on Compensation (BIR Form 2316), if applicable

Certificate of Income Payments Not Subjected to Withholding Tax (BIR Form 2304), if applicable

Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if applicable

Duly approved Tax Debit Memo, if applicable

Proof of Foreign Tax Credits, if applicable

Income Tax Return previously filed and proof of payment, if filing an amended return for the same year

Account Information Form (AIF) or the Certificate of the independent Certified Public Accountant (CPA) with Audited Financial Statements if the gross annual sales, earnings, receipts or output exceed three million pesos (P3,000,000.00)

Account Information Form or Financial Statements not necessarily audited by an independent CPA if the gross annual sales, earnings, receipts or output do not exceed P3,000,000.00 and is subject to graduated income tax rates under Section 24(A)(2)(a)

Proof of prior year’s excess tax credits, if applicableParagraph

Upcloud Accounting

Virtual Outsourced Accounting and Bookkeeping Services in the Philippines

Upcloud Accounting offers online accounting and bookkeeping services specializing with startups and SMEs in the Philippines.

Our goal is to increase efficiency, automation, and transparency across the accounting and finance functions of our clients with our cutting-edge technology.

If you want to move your company’s finance function online, contact our Team of Expert Accountants and Bookkeepers directly via [email protected] or visit www.upcloudaccounting.com to learn more about how Upcloud Accounting accounting services can support your PH business!

Disclaimer: This article or blog is only for general knowledge and guidance and is not a substitute for an expert opinion. For technical advice, please consult your tax / legal advisor for your specific business concerns. For comments, suggestions, and feedback, feel free to email us at [email protected]

Click the button below to schedule a FREE online consultation with us.

Written by: Daztyne Hannah Señeres, 2023, PUP Manila

© 2023 by Upcloud Accounting. Created by Genuinely Business Solutions.