How does the Ease of Paying Taxes (EOPT) Act

simplify the tax filing process?

Ease of Paying Taxes (EOPT) was signed into a law on January 5, 2024, by President Ferdinand Marcos Jr. under Republic Act No. 11976 which took effect last February 22, 2024.

The Ease of Paying Taxes (EOPT) Act simplifies the tax filing process in several ways:

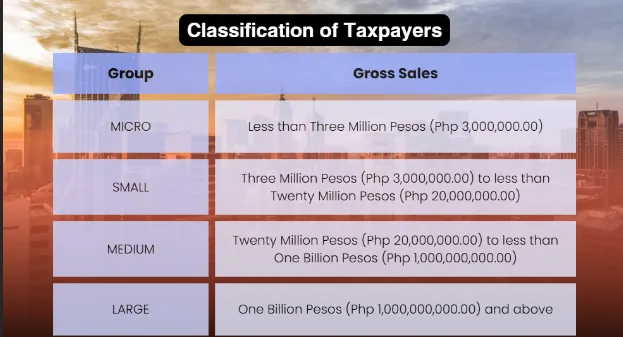

Taxpayer Classification: The EOPT Act categorizes taxpayers into four groups based on their gross sales: Micro, Small, Medium, and Large. This classification helps tailor tax compliance procedures to each group's specific needs.

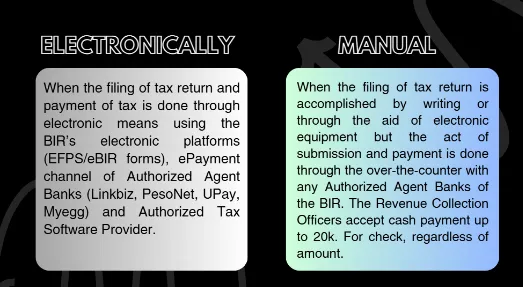

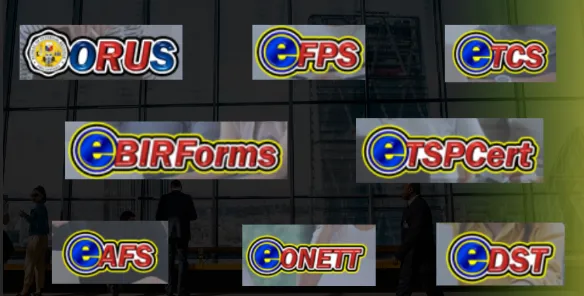

Electronic Filing and Payment: The law allows for electronic filing and payment of taxes, making it easier for taxpayers to comply with their obligations.

Revenue Regulations No. 4-2024 stated under Section 3 that the filing of tax returns and payment of taxes shall be electronically in any of the available electronic platforms. But, in case of its unavailability the manual filing of tax returns may be allowed

Reduced Income Tax Return Pages: For micro and small taxpayers, income tax return forms are shortened to two pages from four, reducing the complexity of the filing process.

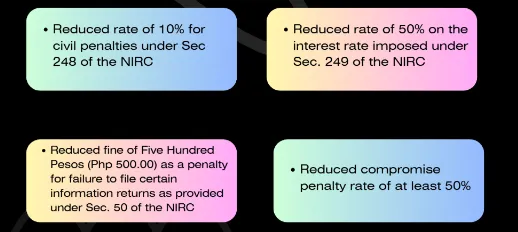

Lowered Civil Penalties: The EOPT Act reduces civil penalties for late filing and payment of taxes, making it less burdensome for micro and small taxpayers.

Section 248, which charges taxpayers a penalty for failing to file returns or pay taxes, reduced the penalty from 25% to 10%.

The interest rate applied to unpaid taxes under Section 249 of the Tax Code has been reduced by 50%. This interest is assessed on tax amounts that are not paid by the due date.

The penalty for micro and small enterprises who fail to file certain information returns, statements or lists or keep any record under Section 250 (Failure to File Certain Information Returns) is reduced from ₱1,000 to ₱500.

The compromise penalty rates for violations of Section 113 (Invoicing and Accounting Requirements for VAT-Registered Persons), 237 (Issuance of Sales or Commercial Invoices) and 238 (Printing of Sales or Commercial Invoices) of the Tax Code is also reduced by 50%.

Digitalization Roadmap: The Bureau of Internal Revenue (BIR) is tasked with developing a digitalization roadmap to ease tax compliance, including the adoption of automated end-to-end solutions and digitization of BIR services.

Account enrollment application shall be one (1) authorized user per Tax Identification Number (TIN) basis, or one authorized user on behalf of multiple Branches, whichever is applicable/convenient to the taxpayer.

In case the eSales system is UNAVAILABLE on the deadline of submission of monthly sales report. The taxpayer must submit the monthly sales report in softcopy (CD FORMAT) using the prescribed format in Annex B2 to the concerned RDO following the procedures in Annex C, including the transmittal form (Annex N).

In the case of MULTIPLE SUBMISSIONS or amendments of the monthly sales report, the MOST RECENT SUBMISSION shall be considered as the FINAL monthly sales report.

Amendments of monthly sales report for a particular month can be made up to THREE (3) TIMES.

For every submission of the monthly sales report, the eSales system will assign a SALES REPORT NUMBER (SRN) to acknowledge the receipt of such report by BIR. Taxpayer can view the summary of their monthly sales report by accessing the eSales system

Submission of monthly sales report can done up to 11:59PM on the due date. However, for this purpose, the time of the BIR shall be considered the OFFICIAL TIME in determining whether the taxpayer submitted within the deadline.

In case the deadline falls on a non-working day, the NEXT WORKING DAY shall automatically be considered the due date.

Any taxpayer required to transmit sales data to the Bureau’s electronic sales reporting system but fails to do so, shall pay, for each day of violation, a penalty amounting to one-tenth of one percent (1/10 of 1%) of the annual net income as reflected in the taxpayer’s audited financial statement for the second year preceding the current taxable year for each day of violation or Ten thousand pesos (₱10,000), whichever is higher: Provided, That should the aggregate number of days of violation exceed one hundred eighty (180) days within a taxable year, an additional penalty of permanent closure of the taxpayer shall be imposed. (Section 264-A under Chapter II, Title X of the NIRC, as amended).

Online Processing of Tax Processes: The EOPT Act enables online processing of tax processes, such as registration and cancellation of BIR registration, filing and paying internal revenue taxes, and claiming input tax credits.

Application for registration and cancellation of BIR registration can be done electronically or manually with the appropriate Revenue District Office.

For claiming input tax credits, the previously required information on Business Style in the Sales Invoice is no longer needed.

The filing and payment of annual registration fee of Five Hundred Pesos (Php 500.00) is also waived.

These changes aim to simplify the tax filing process, reduce the burden on taxpayers, and enhance the overall efficiency of tax administration in the Philippines.

Upcloud Accounting

Virtual Outsourced Accounting and Bookkeeping Services in the Philippines

Upcloud Accounting offers online accounting and bookkeeping services specializing with startups and SMEs in the Philippines.

Our goal is to increase efficiency, automation, and transparency across the accounting and finance functions of our clients with our cutting-edge technology.

If you want to move your company’s finance function online, contact our Team of Expert Accountants and Bookkeepers directly via [email protected] or visit www.upcloudaccounting.com to learn more about how Upcloud Accounting accounting services can support your PH business!

Disclaimer: This article or blog is only for general knowledge and guidance and is not a substitute for an expert opinion. For technical advice, please consult your tax / legal advisor for your specific business concerns. For comments, suggestions, and feedback, feel free to email us at [email protected]

Click the button below to schedule a FREE online consultation with us.

© 2023 by Upcloud Accounting. Created by Genuinely Business Solutions.