What are the Allowable Tax Deductible Expenses from BIR?

Every business has its own Income and Expenses that needs to be monitored so you would know where your business is standing. However, not all expenses can be deducted for your taxes, and we have to observe certain tests and limitations in claiming expenses.

In theory, all of the concepts below have to be followed, but in the real world, not all comply. This is not only a test of skills and technical knowledge, but it is more a test of integrity.

5 Test and Limitations to observe in claiming Allowable Deductions

Substantiation Requirements - all your expenses must be supported by an Official Receipt issued by your supplier.

Reasonability - Every business has its own business expenses that are necessary to earn revenue. It must be reasonable in its ordinary course of business.

Business Related - The expenses to be claimed as a deduction must be related to the business that you are running. Personal expenses are not allowed to be claimed as a deduction.

Legality - Expenses to be claimed must be legitimate and legal by their very nature.

Withholding Tax Requirements - Under itemized deductions, if a business expense is subject to a withholding tax, it must be withheld from its source and remitted to the BIR otherwise, it won’t be allowed to be claimed as a tax deduction.

Common Expenses subject to Withholding Tax:

Salaries and wages

Professional Fees

Management Consultancy

Rental

Expense payments of Top 20,000 Corporations in the Philippines

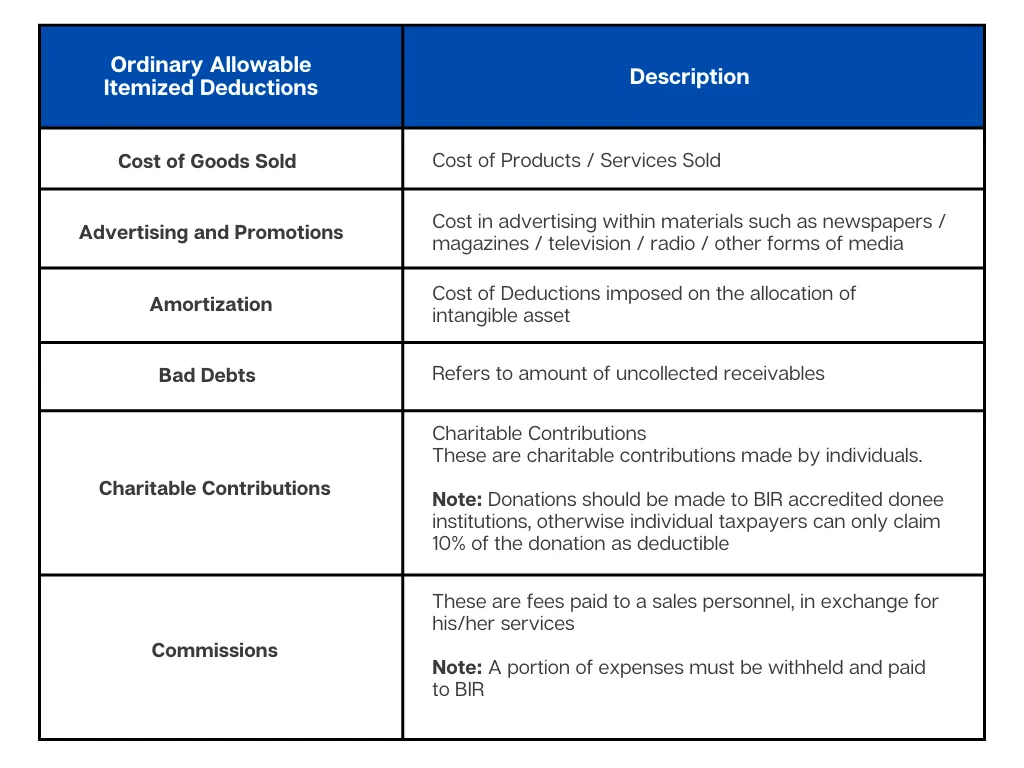

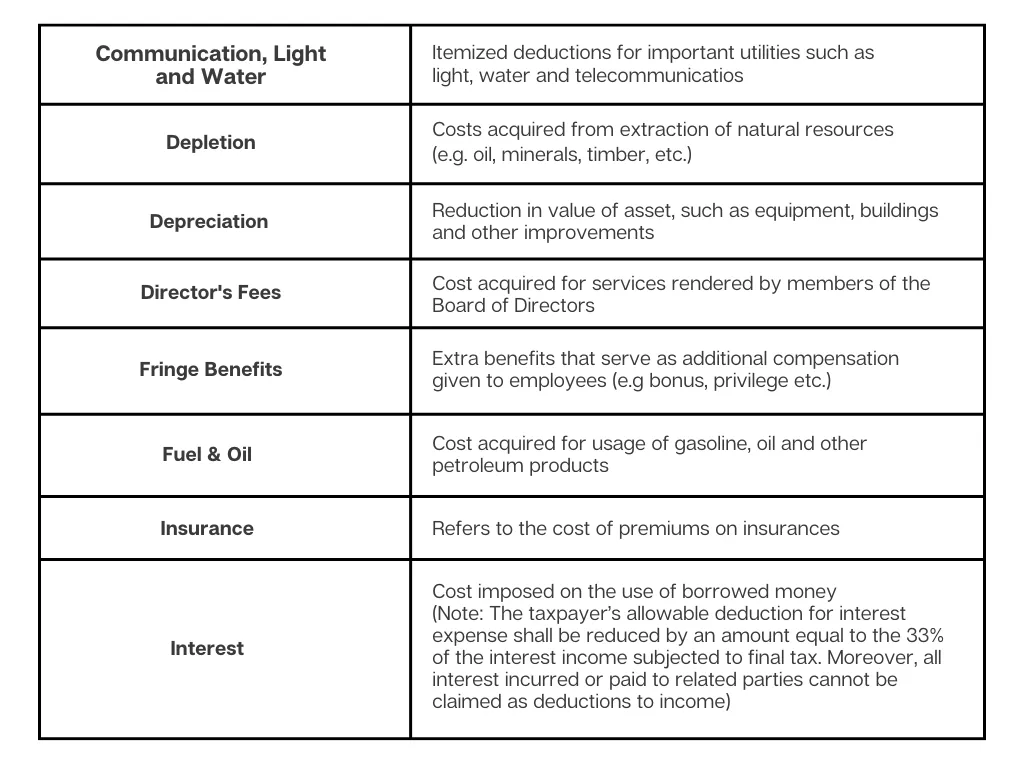

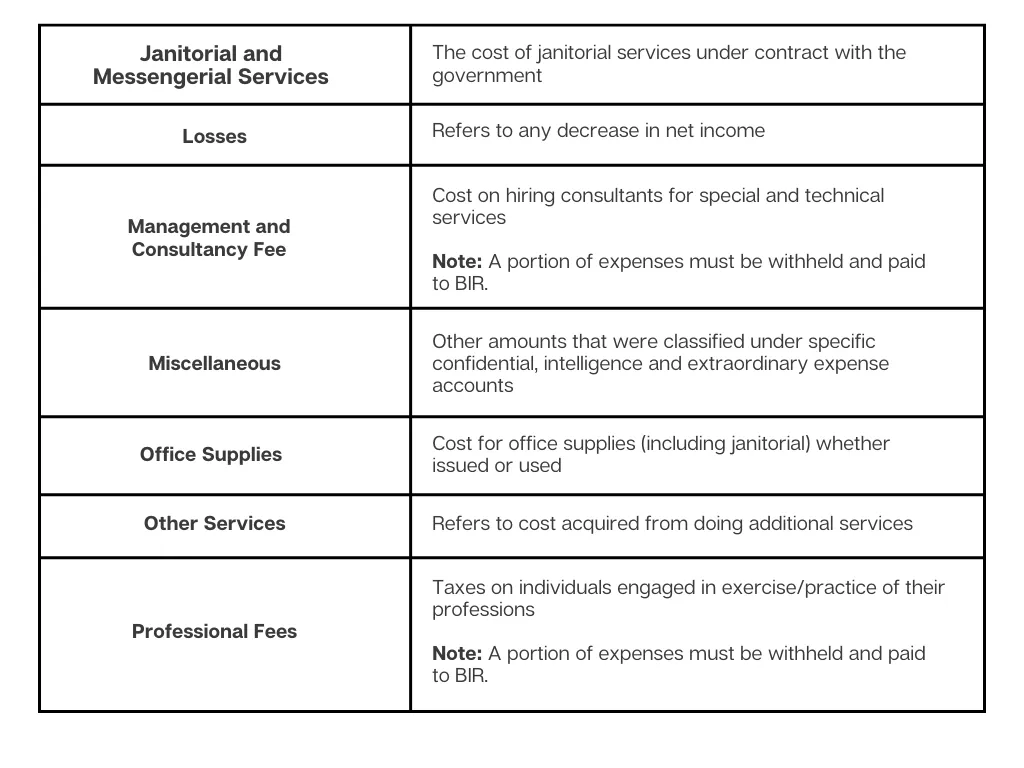

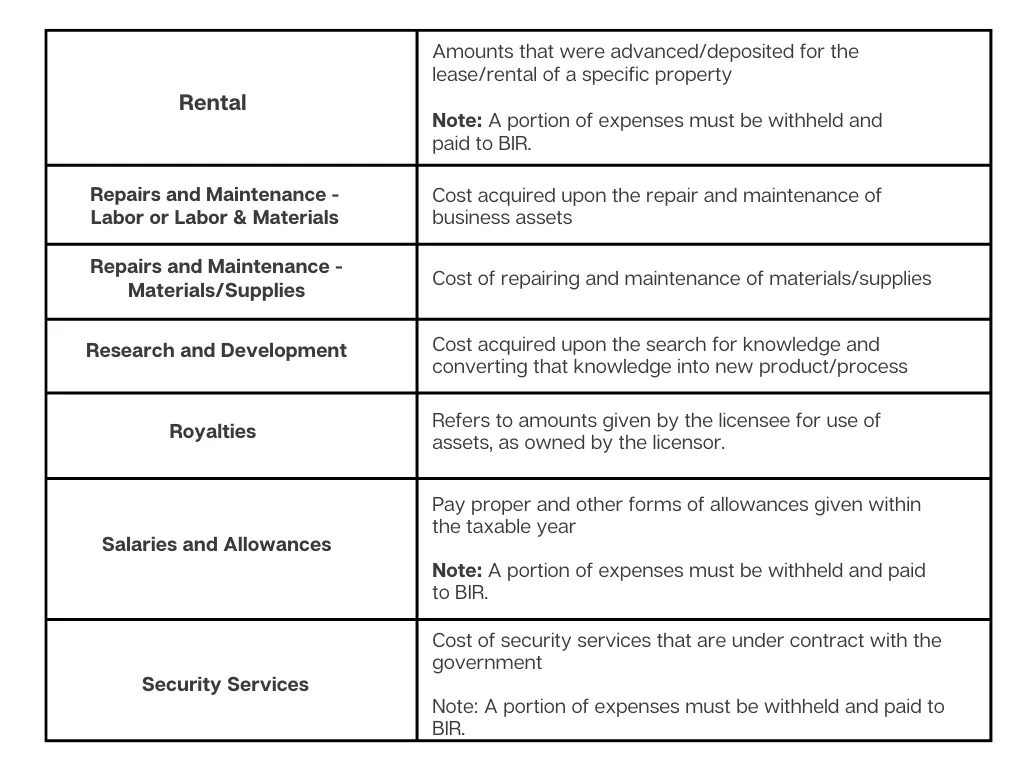

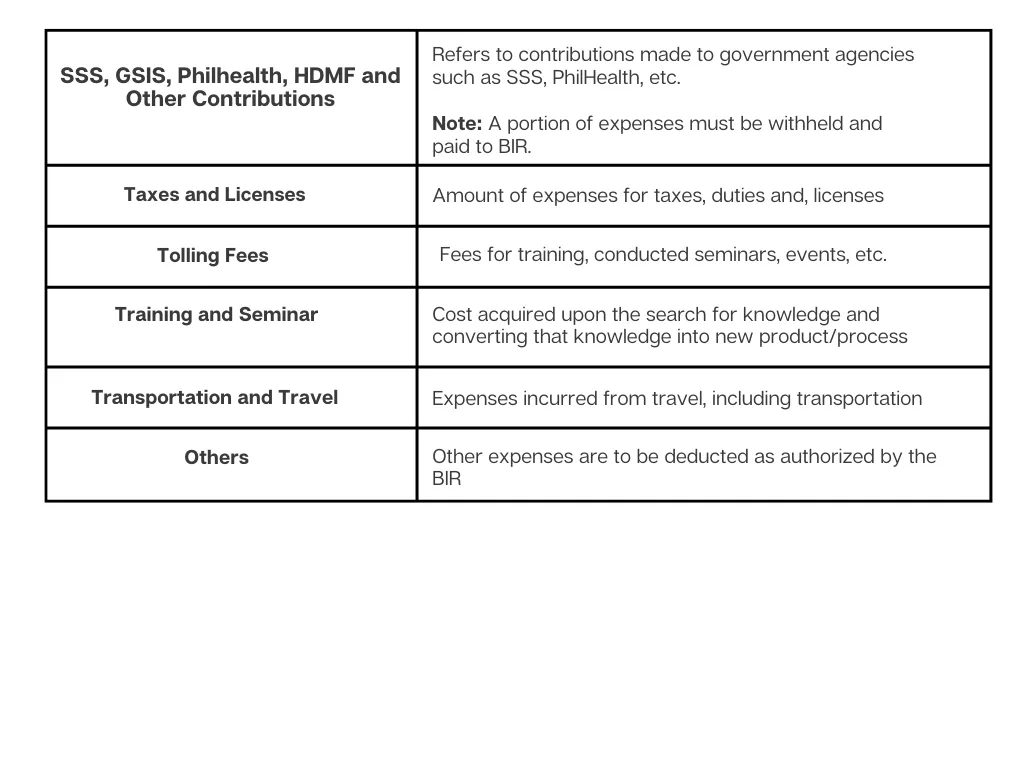

Below are the list of Ordinary Allowable Itemized Deductions with their corresponding descriptions.

Upcloud Accounting

Virtual Outsourced Accounting and Bookkeeping Services in the Philippines

Upcloud Accounting offers online accounting and bookkeeping services specializing with startups and SMEs in the Philippines.

Our goal is to increase efficiency, automation, and transparency across the accounting and finance functions of our clients with our cutting-edge technology.

If you want to move your company’s finance function online, contact our Team of Expert Accountants and Bookkeepers directly via [email protected] or visit www.upcloudaccounting.com to learn more about how Upcloud Accounting accounting services can support your PH business!

Disclaimer: This article or blog is only for general knowledge and guidance and is not a substitute for an expert opinion. For technical advice, please consult your tax / legal advisor for your specific business concerns. For comments, suggestions, and feedback, feel free to email us at [email protected]

Click the button below to schedule a FREE online consultation with us.

© 2023 by Upcloud Accounting. Created by Genuinely Business Solutions.